This is collection of charts and thoughts about markets, trading, investing and speculation (crypto, stocks, bonds, forex etc.). This includes world-wide market data, but also stats and trends for social, people, health, religion and other subjects - anything that I find relevant to better understand geo-politics and geo-economy.

I drop here current, fresh data as well as views on historical things.

It's mostly charts, with not much comments.

The frequency of updates is irregular (from daily to monthly). It's updated ever few days, sometimes weeks.

2022: The after-covid

World's debt by country (the circle)

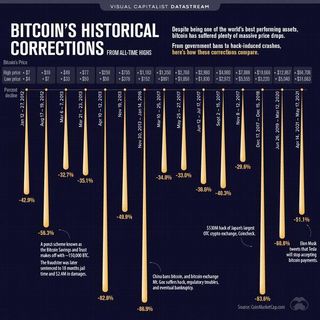

Bitcoin's historical corrections:

2021: The Covid-2 year

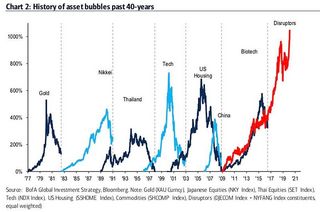

History of asset bubbles past 40-years:

2020: The Covid year

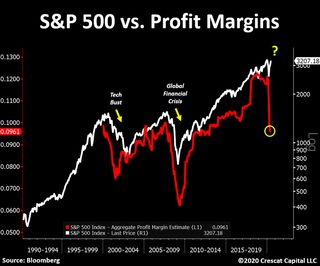

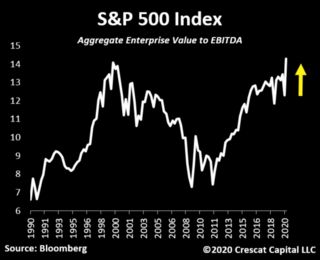

S&P 500 price vs Aggregate profit estimate (1990-2020):

Secular Bear and Secular Bull markets (nominal) against S&P 500 Valuations (Cape 10) and also real earnings.

From 1871 to 2020:

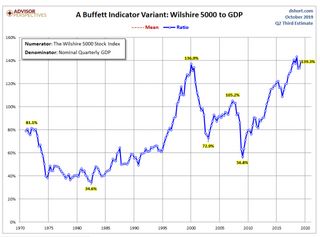

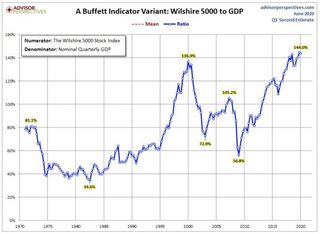

Buffet Indicator - Wilshire 5000 to GDP (to 2020):

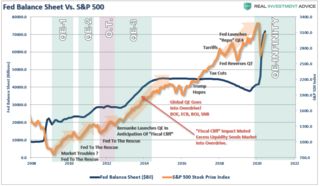

Fed balance sheet vs S&P 500 with additional comments of Quantitive Easing and some "events" (from 2008):

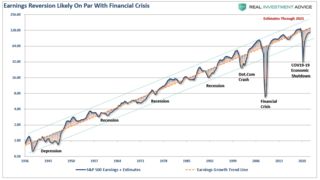

S&P Earnings reversions vs financial recessions from 1936:

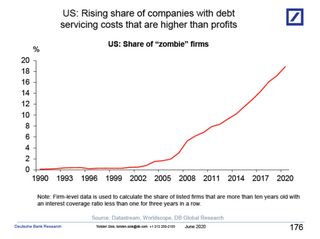

US: Rising share of companies with debt servicing costs that are higher than profits (1990-2020):

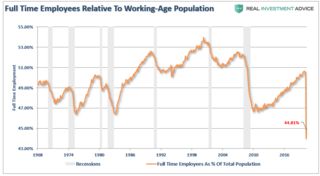

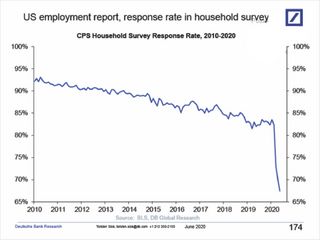

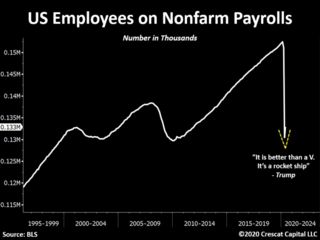

US Employment reports:

- US employment relative to population (is that the same as "participation rate" ?) (1968-2020)

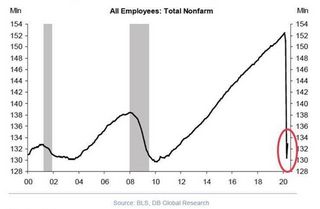

- US employees count on nonfarm payrolls, with "almost v recovery" (1995-2020)

- response rate in household survey by Deutsche Bank (2010-2020)

US Economy In Recessions - Negative GDP Growth (1948-2020):

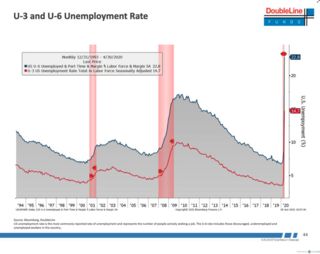

US U-3 and U-6 Unemployment Rate (1994 - 2020):

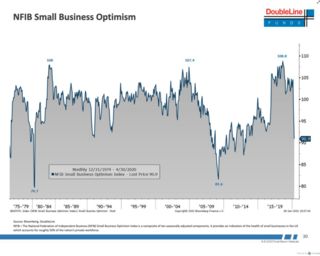

US NFIB Small business optimism index (1975 - 2020):

US All employees Total Nonfarm payroll:

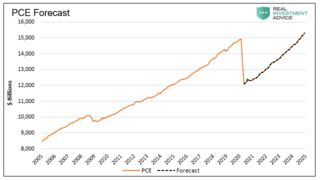

US Personal Spending Forecast:

If the historical relationship between labor and PCE holds up, and consumption continues to be the predominant contributor to GDP, we should not expect GDP to regain prior highs until 2025.

Some math around data

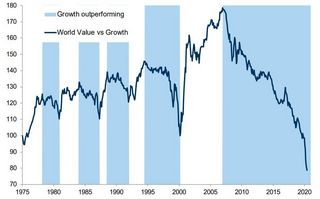

Value vs Growth:

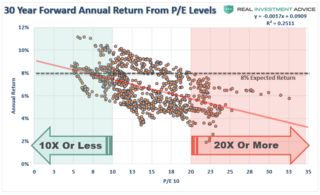

30 Year Forward Annual Return From P/E Levels - 2D Chart:

2019: A bit older stuff

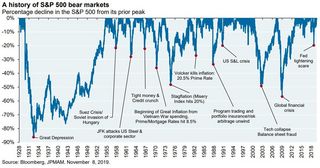

History of S&P bear markets (in percents):

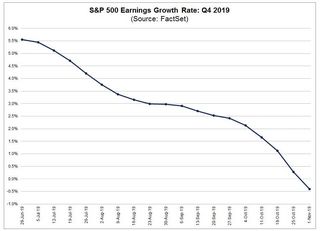

S&P 500 Earnings Growth Rate Q4 2019:

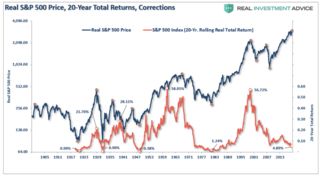

S&P Rolling 20-year rolling real total return:

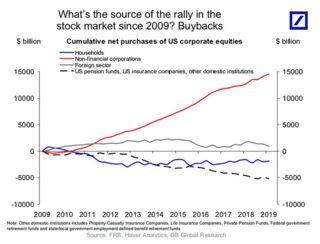

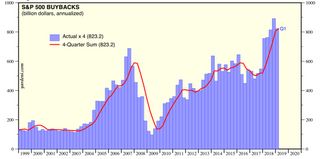

The source of the stock market rally is buybacks:

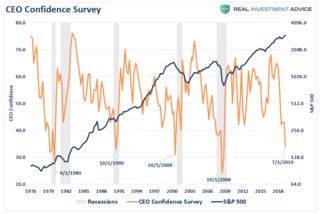

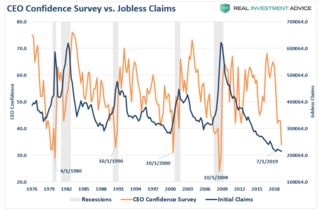

CEO Confidence Survey:

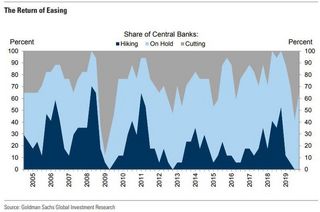

For The First Time In 6 Years, No Central Bank Is Hiking:

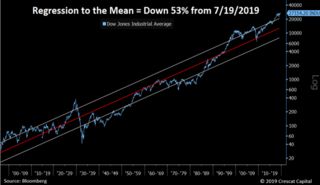

S&P technicals

Negative cash balances (margin debt reported by FINRA):

S&P Accelerated Trend [2019-10-16]:

S&P Buybacks:

S&P 2018-2019 technicals:

S&P 500 Trend Line Support 2007-2019:

S&P 500 Corporate Profits vs S&P Price, with some context - historical comparisons for 2007 and 2000:

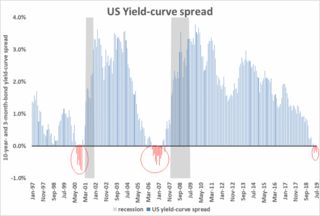

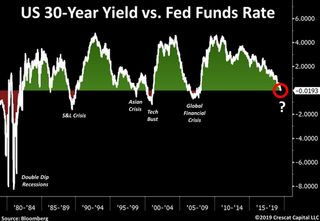

US yield curve spread:

US market

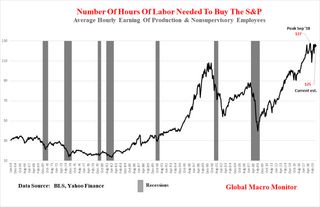

Number of Hours of Labor needed to buy the S&P:

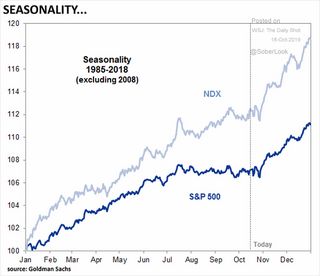

Stock market seasonality as for 2019-10-18:

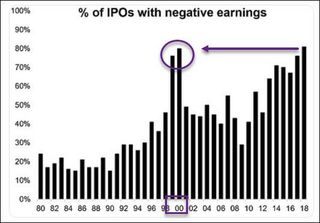

80% IPO-s are now on negative earnings. The historical context on the chart "Percent of IPO-s on negative earnings":

Companies with the highest long term debt in US. Debt-to-equity ratio and size of the debt shown:

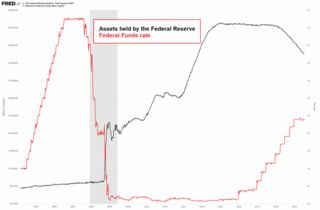

Fed assets vs Federal Funds Rate:

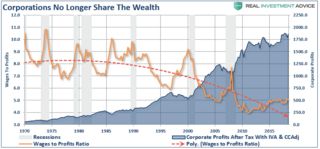

Corporations no longer share the wealth:

Global markets

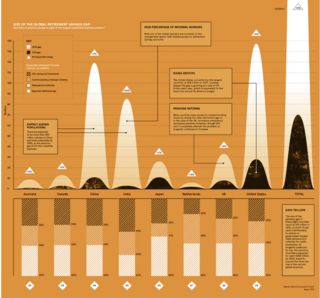

Size of the global retirement savings gap, by 8 biggest countries:

Markets technicals - variety of charts

Global trends, economy, markets, world stocks, people, culture, religion

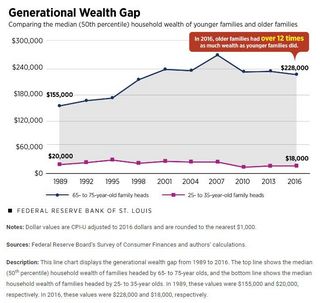

Generational wealth gap in US:

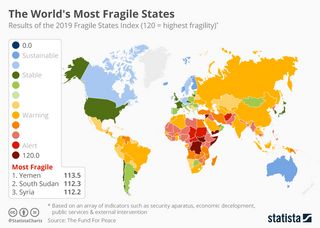

The World's Most Fragile States:

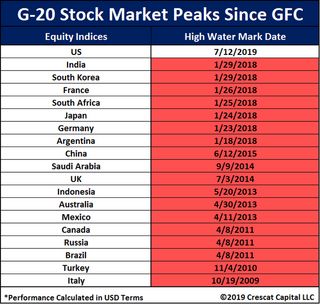

Stock market peaks by country:

Global debt by type:

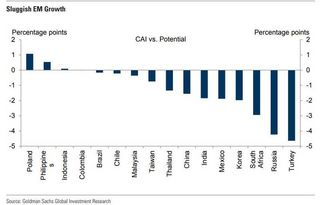

Emerging markets growth:

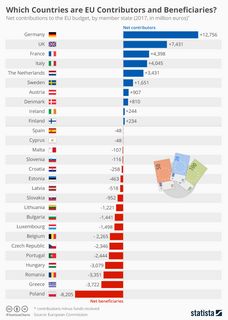

2017 Net contributors to EU budget. Germany +12 B euros, while Poland -8 B euros:

People, culture, religion, health - trends, maps etc.

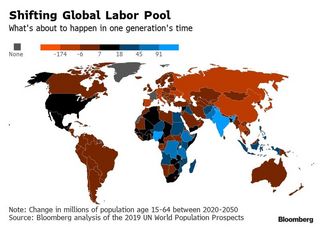

Predicted change in population in one generation's time:

STD (sexually transmitted disease) cases in US chart:

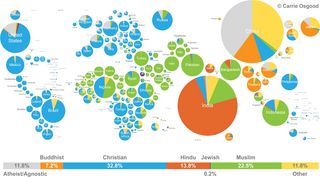

World religions detailed map by country:

General theory, education

Paradigm shifts - by Ray DalioHedge fund stategies

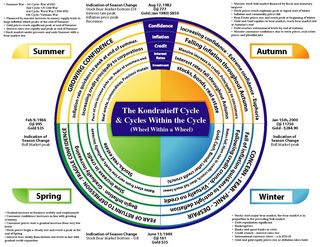

Kondratieff Waves

Kondratieff Waves, Kondratieff Cycles, Kondratieff Disk

Historical data

- S&P 500 Index - 90 Year Historical Chart

- Market Indexes, Commodities, Currencies, Bonds and Economic Gallery

- Oil WTI price historical chart: https://www.macrotrends.net/1369/crude-oil-price-history-chart

- Gold price: in USD 1971 till now, in USD inflation adjusted/non-adjusted

- Silver price: in USD 1971 till now, in USD inflation adjusted/non-adjusted

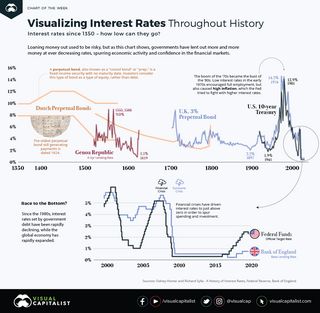

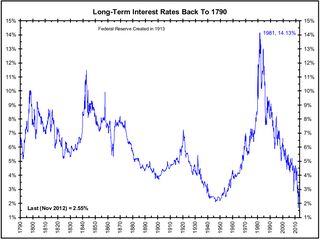

- Long Term interest rates back to 1790 and US+UK interest rates from 1350 to 2020:

Historical S&P return inflation adjusted - Updated 20190516

Historical S&P return inflation adjusted - Updated 20190407

Note: The green lines denote the number of years required to get back to even following a bear market.

It is worth noting the entirety of the markets return over the last 118-years occurred in only 4-periods: 1925-1929, 1959-1968, 1990-2000, and 2016-present)

Current data links

- Tracking: Robin Hood tracker, IG Client Sentiment tracker

- DJIA contracts: https://www.investing.com/indices/us-30-futures-contracts

- CME Group:

S&P: S&P futures

oil: WTI Crude Oil Futures table, Brent Last Day Financial Futures Quotes, Brent Crude Oil Futures

- XTB: Rollover table 2020

Archived

Secular Bear and Secular Bull markets (nominal) against S&P 500 Valuations (Cape 10).From 1871 to 2019:

Buffet Indicator - Wilshire 5000 to GDP: